Learn how to put the intuitive and customizable tools, features, and capabilities of Schwab.com to work for you.

Keep an eye on your investments with real-time updates, data, and information. Compare your current asset allocation to your target allocation or to benchmarks, and make sure your allocation is tracking to your risk tolerance. See the tutorial

Easily connect with a Schwab representative for answers to your questions. To begin, click “Support” in the navigation bar, choose “Chat,” then type “Chat with a representative.”

Our All-In-One Trade Ticket provides easy access to multiple asset types (stocks, exchange-traded funds (ETFs), mutual funds, and options), and lets you place your trades from a single location. See the tutorial

SnapTicket is a new, streamlined trade ticket on Schwab.com that allows you to enter orders directly from key pages in your trading workflow.

Access SnapTicket with a single click on the right side of the following Schwab.com pages: Order status, Research, Client summary, Watchlist, Positions, Balances, Options chain, and Transaction history.

The Order status page on Schwab.com includes a range of customizable features to give you more control over what you want to view. See the tutorial

Invest in ideas you believe in—including Artificial Intelligence, Cyber Security, and Big Data—with data-driven research and a trading platform that helps you discover and invest in unique opportunities. Our research and proprietary technology does the heavy lifting to uncover new opportunities and identify companies that fit each theme.

Create multiple custom watchlists to help you keep a close eye on important details and real-time market data for the securities in your portfolio or ones you are targeting. See the tutorial

Use our Personalized Portfolio Builder to create a portfolio that consists of mutual funds or ETFs in just a few steps. This tool may be ideal for investors without the time or interest to focus on portfolio building. See the tutorial

Get a convenient view of your received and estimated dividends and investment income. See the tutorial

Portfolio Performance helps you review what your account or portfolio has gained and lost over time to see how your money is working for you.

We show two views of performance: value vs. net contributions and rate of return. The difference between value and net contributions is a good indicator of the market’s role in your gains and losses. You can also compare your performance to indexes to see how you stack up against different market segments.

Use your personal dashboard to easily view account details and monitor performance compared to the benchmark index. See the tutorial

Discover mutual funds or ETFs that match your preferences within several criteria including category, ratings, and transaction fees. Select up to five of your search results to compare in a side-by-side chart. See the tutorial

Intuitive and powerful digital tools help you quickly filter and find investment candidates that meet your criteria, including:

Access premium, independent research reports from Morningstar® and Argus for a balanced perspective on whats going on in the markets.

You can also view in-depth analysis on individual securities, including buy/hold/sell recommendations from MSCI, LSEG Data & Analytics, MarketEdge, CFRA, and Vickers.

Quickly scan breaking market news with the top headlines of the day from leading providers, such as Reuters and Briefing.com. Filter the news to see only the sources you want, or search the news by keyword or symbol.

View performance of major markets and indices around the globe, with the ability to customize your time frame to identify trends youre interested in.

If you want to transfer funds from a Schwab account, you have several routes to choose from: online transfer, wire transfer, or requesting a check. See the tutorial

From the Online Transfer page, select the accounts, and then choose the share amount for each security you would like to transfer. Please be aware that some positions, like short positions, are not available to transfer. See the tutorial

Browse the list of company categories or search directly for the biller youre looking for. If you search for a biller that does not exist in our network, you will be prompted to manually add them. Choose the biller you would like to pay and enter the requested billing information. Youll receive a confirmation message once your payment process is complete. See the tutorial

For each account and issued debit card, you have several alert options to choose from. You can select how you would like to receive alerts as well as the type of activity you would like to be alerted for.

To get started, log in, click “Support,” and select “Debit Cards & Checks.” Then select “Debit Card Alerts.”

If youve misplaced your Schwab Bank Visa® Platinum debit card, you dont have to immediately cancel your card. Instead, you can simply lock your card as you continue to search for it—a process that takes just minutes from your phone.

However, if you think your card was stolen, you should call Schwab Bank immediately at 1-888-403-9000.

Stay on top of the ever-evolving financial landscape with timely market insights and educational resources tailored to empower you on your financial journey. Learn the way you want with curated experiences including articles by trading experts, videos, podcasts, interactive courses and more.

Our comprehensive online courses guide investors through the basic and more advanced elements of important financial concepts, including retirement portfolio management, trading with technical analysis, income investing, and more. Courses include quizzes, wrap-ups, and additional resources.

Schwab Assistant is a virtual agent that can answer questions, provide general information, help you navigate the site, and more. See the tutorial

You can also use it to chat with a live representative. To begin, click “Support” in the navigation bar, choose “Chat,” then type “Chat with a representative.”

Paying bills can be a tedious task. But with Charles Schwab Bill Pay, managing your payments is easier than ever. This handy online service allows Schwab clients to quickly pay bills or send money from the comfort of their computer or mobile device. In this article, I’ll walk you through everything you need to know to log in and start using Charles Schwab Bill Pay.

Getting Started with Charles Schwab Bill Pay

To access Charles Schwab Bill Pay, you first need to have an eligible Charles Schwab account. This includes many of their brokerage banking and retirement accounts.

Once you have a qualifying Schwab account, enrolling in Bill Pay is simple. Just log in to your Schwab account and navigate to the Bill Pay section. Here you can easily enroll an existing account or link a new account to use for Bill Pay.

Schwab Bill Pay is available at no extra cost for eligible account holders. It’s just one more perk of banking with Charles Schwab.

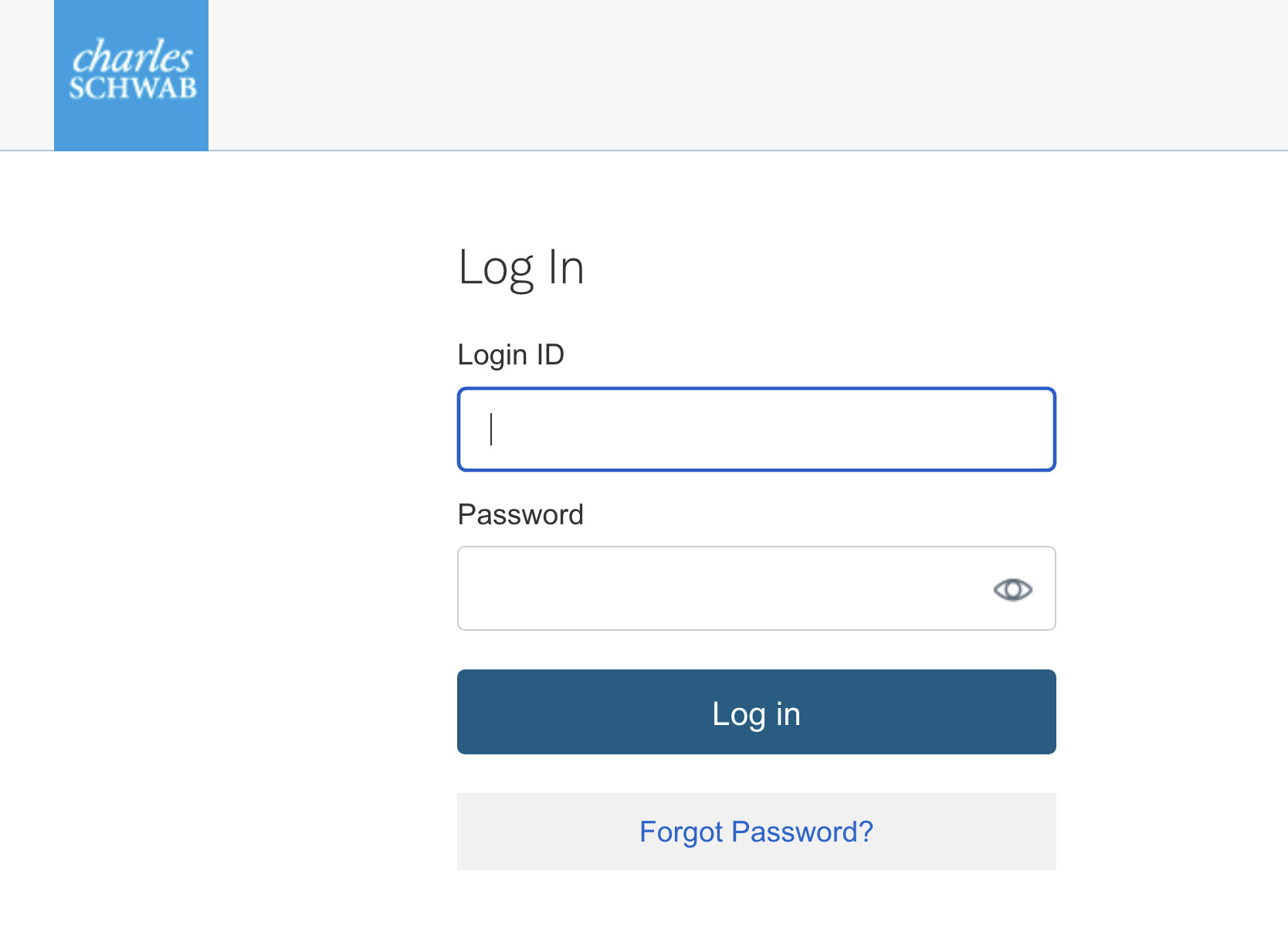

Logging In to Your Charles Schwab Bill Pay Account

Gaining access to your Charles Schwab Bill Pay account is quick and straightforward. Here are the steps:

-

Go to the Charles Schwab website login page at https://client.schwab.com/Areas/Access/Login.

-

Enter your Schwab username and password and click “Log In”

-

From your Schwab account dashboard, find and click on the Bill Pay tab This will open the Bill Pay portal.

-

If prompted, enter your Charles Schwab Bill Pay username and password. These may be the same as your main Schwab credentials.

Once logged in, you’ll arrive at the Bill Pay dashboard where you can manage payments, view activity, and access key features.

Resetting Your Charles Schwab Bill Pay Password

If you forget your password for Charles Schwab Bill Pay, resetting it is easy. Here’s how:

-

On the Bill Pay login page, click “Forgot Password?”.

-

Enter your Charles Schwab Bill Pay username when prompted.

-

Choose to reset your password by text or email.

-

Follow the verification steps to create a new password.

You can also reset your Bill Pay password by logging in to your main Schwab account. From the profile menu, choose “Change Login Credentials” and update your Bill Pay password there.

Key Features of Charles Schwab Bill Pay

Charles Schwab Bill Pay makes managing bills and money transfers simple. Key features include:

-

One-time and recurring payments – Schedule one-off or automatic recurring payments to any payee.

-

eBills – Enroll and manage bills from participating companies in one place.

-

Money transfers – Quickly send money to others using their email address or account details.

-

Mobile access – Manage payments on-the-go with the Schwab mobile app.

-

Alerts – Get notified when bills are due, payments are made, and more.

-

Payment history – View up to 18 months of Bill Pay transaction history.

-

Security – Schwab Bill Pay leverages multiple layers of protection to keep your information safe.

Paying Bills with Charles Schwab Bill Pay

Paying your bills through Charles Schwab Bill Pay is straightforward. To schedule a new payment:

-

Log in to your Bill Pay account.

-

Click “Pay a Company or Person”.

-

Choose the account to withdraw funds from.

-

Enter the payee name and payment details.

-

Select a delivery date for one-time payments or set up a recurring schedule.

-

Review the payment details and submit.

Funds for electronic payments will be debited from your Bill Pay account on the delivery date. Mailed payments will withdraw funds when the check clears.

You can pay almost any company or individual with Charles Schwab Bill Pay. From utility bills to rent to contractor payments, Bill Pay has you covered.

Sending Money Transfers with Schwab Bill Pay

In addition to bill payments, you can quickly send one-time money transfers to others using Charles Schwab Bill Pay.

To send a transfer:

-

Log in and access the money transfer tab.

-

Enter the recipient’s name, email address or account details.

-

Input the transfer amount and delivery date.

-

Select a source account to withdraw funds from.

-

Review and submit the transfer.

Recipients will receive a notification with instructions on how to deposit the funds. For bank account transfers, money is usually available in 1-3 business days.

Money transfers let you easily pay friends, deposit funds into another of your accounts, and more. It’s a convenient feature of Schwab’s Bill Pay service.

Managing Charles Schwab Bill Pay on Mobile

In addition to the desktop experience, Charles Schwab Bill Pay offers user-friendly mobile access. You can manage payments and transfers from your iOS or Android device.

To use Bill Pay on mobile:

-

Download the Schwab Mobile app and log in with your credentials.

-

Tap on the Bill Pay tab to manage payments, view activity, enroll new payees, and schedule transfers.

-

Receive notifications for upcoming due dates, successfully delivered payments, and other activity.

-

Use biometric login like fingerprint or face ID for quick, secure access.

Charles Schwab Bill Pay combines robust desktop features with excellent mobile convenience. You can manage your account anytime, anywhere.

Getting Help with Charles Schwab Bill Pay

If you ever have questions or need assistance using Charles Schwab Bill Pay, customer support is there to help.

You can access Bill Pay support by:

-

Calling the dedicated Bill Pay support line at 1-888-403-9000.

-

Initiating a live chat from within your Bill Pay account.

-

Messaging support after logging in to Bill Pay.

-

Contacting general Schwab support who can transfer you if needed.

Charles Schwab aims to provide exceptional service. Their customer support team is available to provide quick, knowledgeable answers on Bill Pay or any Schwab product.

With intuitive online and mobile access, robust features, and excellent support, Charles Schwab Bill Pay makes managing bills and transfers easy. Now you know the ins and outs of logging in, resetting your password, using key features, making payments, and getting help when needed. Sign up for Charles Schwab Bill Pay today and simplify your payments.

Adding trusted contacts and beneficiaries

You can easily add a person that Schwab would contact if we are unable to communicate with you regarding issues related to your account. You can also edit or manage the beneficiaries on each of your accounts. See the tutorial

Authorize limited or full trading authority (LTA or FTA) to a third party to act on your behalf in connection with your account. LTA provides view-only access to account information and the ability to trade, while FTA provides the same plus the ability to move money. See the tutorial

A trusted device is a device you use frequently, such as your personal cell phone, tablet, or home computer. See the tutorial

- You can quickly and easily add, review, or remove trusted devices from your profile.

- You can review a list of all devices that have completed the 2-step verification process for your account.

- You can give a custom name to a device to help you quickly recognize it in case you use multiple devices.

You can set up alerts to track the activity of individual securities covering a range of criteria, including:

You can choose the delivery method of the alert – by email or by wireless text message. See the tutorial

Charles Schwab Sign In: How to Login to Your Charles Schwab Online Banking Account?

FAQ

Does Charles Schwab have online bill pay?

Can I pay bills from my Schwab account?

What is the phone number for Charles Schwab support?

What is the interest rate for Schwab Bank investor checking?

How do I use Charles Schwab Bank bill pay?

Click Continue under Charles Schwab Bank to launch the bill pay service. Narrator: From here, you’ll be able to manage and send money to your billers. Before setting up a payment, you’ll have to add the biller to your Schwab Bank Bill Pay profile. Next, click on Autopay to set up a recurring payment to a biller.

Is Charles Schwab a bank?

Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC), offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides deposit and lending services and products.

How do I set up online payments through my Schwab account?

If you’d like to set up online payments through your Schwab Brokerage or Investor Checking account, you’ll first need to add a biller, or payment recipient. The screen fades to the Schwab.com platform. Begin by clicking “Move Money” and choosing “Pay Bills.” A cursor rolls over and clicks “Move Money”, and then clicks “Pay Bills.”

Who can use Schwab BillPay?

Schwab BillPay is available to Schwab One® (with checkwriting feature) account holders only; it is not available for certain accounts such as business, corporate, trust (except living trust), estate, custodial, international, or IRA accounts. Name on Schwab One account Print name as it appears on your Schwab statement.

What services does Charles Schwab offer?

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC), offers investment services and products, including Schwab brokerage accounts.

Is Charles Schwab Bank a member of the FDIC?

Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. This site is designed for U.S. residents.